What's New

How Microfinance Institutions

Can Digitize Without Breaking the Bank

Explore Our Blog Library

Oct 27, 2025

How Microfinance Institutions Can Digitize Without Breaking the Bank

Microfinance institutions (MFIs) are the financial lifeline for millions across emerging economies. But while demand for access to credit continues to grow, many MFIs are struggling to keep up—not because of lack of will, but the lack of tech...

Oct 20, 2025

The Digital Lending Landscape in 2025: Trends, Tech, and Transformation in Southeast Asia

In 2025, Southeast Asia stands at the forefront of a lending revolution. As traditional, paper-based workflows fade, digital-first platforms are taking center stage—offering speed, scalability, and regulatory confidence...

Oct 13, 2025

How Personalized Offers Improve Customer Retention in Consumer Lending

Let’s be real, getting customers is tough, but keeping them is even tougher in the consumer lending space. With so many lenders offering competitive rates and fast approvals, borrowers have plenty of...

Oct 6, 2025

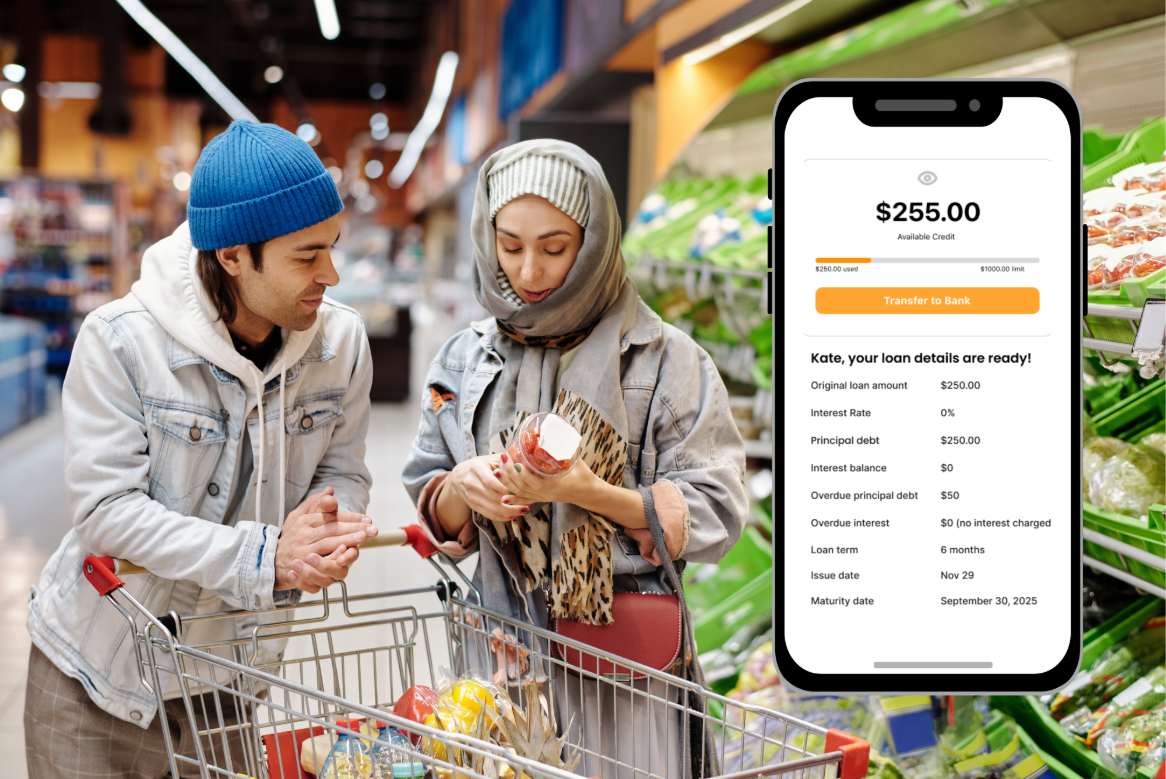

Simplifying the Loan Application Process with Sivren’s Consumer Lending Solutions

In today’s fast-paced digital world, consumers expect speed, convenience, and transparency in every transaction especially when it comes to borrowing money...

Sept 1, 2025

Why Fraud Prevention Is Mission-Critical for Modern Consumer Lenders

As digital lending becomes the norm, the risks increase. Lending fraud is evolving—faster applications, more complex schemes, and higher stakes for lenders trying to scale..

August 4, 2025

How Technology is Making Consumer Loans More Accessible & Affordable

In a world where nearly everything happens online like shopping, banking, even healthcare, it's no surprise that consumer lending is undergoing...

July 7, 2025

Modernizing Commercial Lending: How Sivren’s Automated Workflows Drive Efficiency and Growth

The commercial lending landscape is undergoing a rapid transformation. Rising borrower expectations, tightening regulations, and fierce...

June 2, 2025

The Future of Commercial

Lending is Here

The future of business financing isn’t just coming, it’s already here. And it’s empowering businesses to move faster, grow smarter, and lead with confidence.

May 5, 2025

7 Key Challenges in Commercial Lending and How to Overcome Them

In today’s fast-paced business landscape, commercial lending is the engine that powers growth, innovation, and opportunity.

Sivren specializes in creating custom software solutions for moneylenders, designed to enhance operational efficiency and meet their specific needs. We pride ourselves on our commitment to quality, customer satisfaction, and building lasting partnerships within the financial technology sector.

© 2024. Sivren Pte Ltd (UEN: 201006285G). All rights reserved

Feel free to email us at [email protected] or reach out via WhatsApp at +65 8010 5519